Introduction to savings accounts

What is a savings account?

You can create savings accounts for centers, groups, and clients based on the savings products defined in Mifos. All accounts inherit the rules of the product they are created from.

Note: The savings product must be in an Active state before you can create an account based on it.

Savings accounts are vital to the economic health of the client or group. MFIs encourage regular contributions to these accounts, and in some cases make contributions mandatory. Your MFI could make a rule that you cannot create loan accounts for borrowers unless their savings accounts are at a minimum level. You may also make a rule that the client or group does not earn interest if the savings account is lower than a specified minimum amount.

If you create a savings account for a group or a center, all members of the group or center can deposit to and withdraw from these accounts. Usually, when a transaction is made, the user chooses the client name from a list of approved clients belonging to that group or centre.

A center, group, or client can have more than one account, of the same or different savings products, but a single account cannot be shared by more than one center, group, or client. In addition, no conversion is allowed between individual client accounts and center/group accounts.

Mandatory versus voluntary savings

Some MFIs make their savings accounts mandatory. The minimum deposit amount is considered "due" at every meeting day of the account owner. Partial payments are allowed. If the client or group does not make this minimum deposit on time, the required deposit amount at the next meeting is increased by that amount. For example, if the minimum deposit is 50, and the client does not pay, then at the next meeting, the required deposit will be 100. If the minimum deposit is 50 and the client pays 25, then at the next meeting, the required deposit will be 75.

If the savings account is held by a center, the deposit amount is applied to all clients in Active or On Hold states. If the savings account is held by a group, and the minimum deposit applies to each group member separately, the deposit amount is applied to clients in Active or On Hold states.

Voluntary accounts have no minimum deposit, though there is a "recommended deposit" amount that can be included in the definition of the savings product.

The savings account "dashboard"

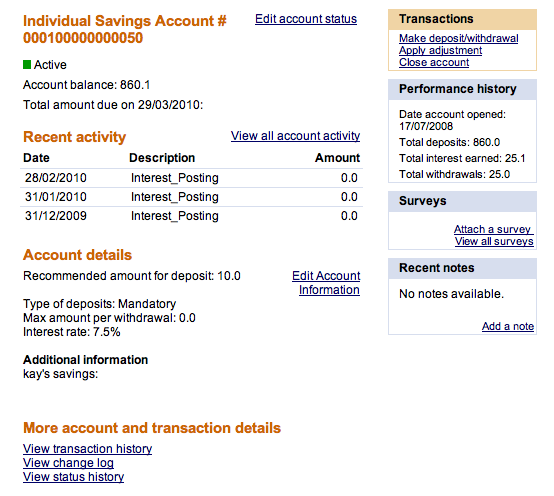

The savings account details page ("dashboard") shows the detailed transactions and functions related to savings accounts. It includes the account status, the recent activity status, and transaction tracking details.

To view the dashboard, in any Search box, type the account number for the savings account. You can also type the client or group name and click the account link from the details page for that client or group.

The screen might look like the following:

The dashboard might include the following items:

|

Category |

Description |

|

Savings account header |

Savings account number, current status, balance, and amount due at next meeting (if account is mandatory) |

|

Recent Activity |

A list of transactions that have taken place with regard to the account. |

|

Account Details |

Shows the savings account details, which include recommended or mandatory amount for deposit, type of deposit, maximum amount allowed per withdrawal, and interest rate. |

|

More account and transaction details |

Shows the status history, change log, and change history for the loan account. |

|

Transactions |

Provides the links to making a deposit, withdrawal, or adjustment, or closing the savings account. |

|

Performance history |

Show various account performance indicators, such as total deposits, withdrawals, and interest. |

|

Recent Notes |

Shows the three most recent notes appended to the account, with additional links to add a new note or view all the notes. |