How to define and change savings products

Before you can create individual savings accounts, you must define a savings product. All savings accounts are created from these products and inherit their characteristics.

Savings products can be set up for mandatory or voluntary deposits. If the account holder does not make any deposits to or withdrawals from the account in a certain period of time (the default is 30 days), the account becomes dormant.

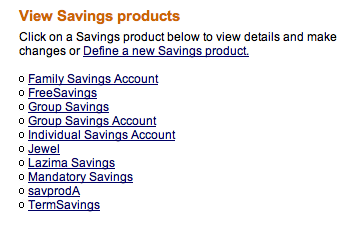

Note: If you want to see the savings products that have already been created before making a new one, click Admin > View Savings Products and click any of the products displayed on that screen. From that display, you can make changes to the existing savings products.

Follow these instructions:

- Click Admin > Define New Savings Product.

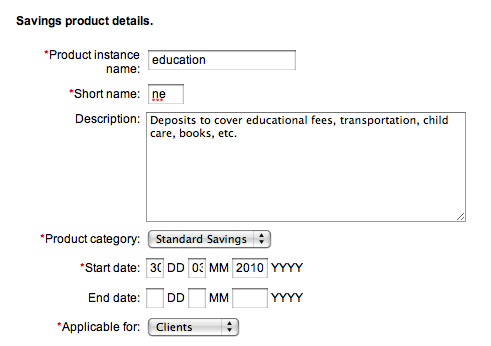

A screen appears with all the specifications for the product. The first part of the screen looks like this:

I

- Enter information using the descriptions in the following table:

|

Field name |

Description |

|

Product instance name |

The full name of the savings product being defined. |

|

Short name |

An abbreviated version of the name, used in reports or menus where space is limited such as the Collection Sheet. |

|

Description |

A description of the savings product: its purpose, eligible recipients, or other information that will help an employee determine whether it is appropriate for a particular client. |

|

Product Category |

A selection from the list of all the active savings product categories. |

|

Start Date |

The full date after which products of this type may be issued. |

|

End Date |

The last date on which products of this type may be issued. |

|

Applicable For |

Click whether this is an account given only to centers, groups, or individual clients. |

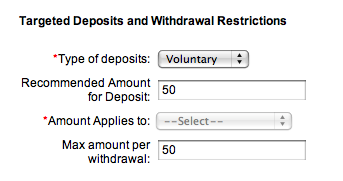

The next section sets rules for deposits and withdrawals.

3 Enter information using the descriptions in the following table:

|

Savings product attribute |

Description |

Example |

|

Type of deposits |

Click whether deposits are voluntary or mandatory. A voluntary deposit means that the client(s) or group(s) assigned this product are not obliged to save; a mandatory product means that savings deposits must be made as defined in the product. |

Mandatory |

|

Recommended amount for deposit |

Type the recommended value of each deposit. If the type of deposit is mandatory and the savings account requires a monthly deposit, for example, the client(s) or group(s) must make a savings deposit on a monthly basis. |

1000 |

|

Recommended Amount Applies to |

If you chose Groups in the Applicable For list above, you can choose who the recommended savings amount applies to: the individual or the group. That is, the group could be responsible for the deposit amount, dividing it up among the clients in the group, or each client could be individually responsible for the deposit amount. In a center savings account, the recommended amount always applies to the client. |

Complete Group |

|

Max amount per withdrawal |

Type the largest amount of money that can be withdrawn from the account at any given time. |

200 |

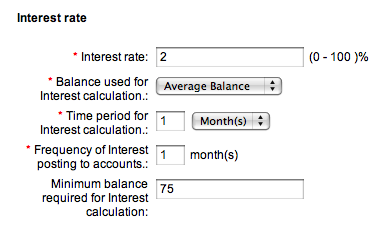

The next section deals with setting interest.

4 Enter information using the descriptions in the following table:

|

Savings product attribute |

Description |

Example |

|

Interest rate |

Type the applicable interest rate. |

|

|

Balance Used for Interest Rate Calculation |

Select the type of balance that will be used for interest: minimum balance or average balance. Compound interest is the only method supported as a basis of calculating interest. If you change this setting, the change is reflected in the open accounts as soon as the change is detected by Mifos. If the attribute is modified, the interest installments should be recalculated. |

Minimum Balance |

|

Time Period for Interest Rate Calculation |

Enter the time period when the interest can be calculated. 1 month means that the interest rate will be calculated at the end of every month. |

Computation: A = P(1+r/n) Where: |

|

Frequency of Interest Posting to Accounts |

Type the frequency of posting into the accounts (for example, interest is posted to the savings accounts once a month). Changes to this account will affect future transactions only. The frequency of deposit is inherited from the client's meeting frequency. |

1 month = every month. Posting is always at the end of the period defined. |

|

Min balance required for interest rate calculation |

Enter the smallest balance that the account must have before it can accrue interest. If the amount is lower than the amount entered here, interest will not be applied. |

10 |

- In the Accounting section, if you have general ledger codes for deposits and interest, click those codes in each list.

- When you have made all choices for this savings product, click Preview.

- Review your choices. If you want to make changes, click Edit Savings Product Information, make changes, and click Submit. (If you decide not to create a savings product at this time, click Cancel.)

How to change savings products

If you change savings products that are already in use, the changes affect all future savings accounts created from those products, but they do not affect savings accounts that were created before. Follow these instructions:

- Click Admin > View Savings Products.

A screen appears like the following:

- Click the link for the product you want to change.

- In the screen that appears, review the terms of the product.

- Click Edit Savings Product Information and proceed as in the procedure above, clicking Submit when you are done.