How to change the status of centers, groups and clients

- Overview of status states for centers, groups, and clients

- How to change the status of a center

- How to change the status of groups and/or clients

Overview of status states for centers, groups, and clients

From the details page (dashboard) for centers, groups, and clients, you can change the status from active to inactive, or vice versa. (Clients and groups can have other statuses as well.) The procedure is the same for all three entities. A green square next to the center, group, or client name means that it is active.

How to change the status of a center

The following rules apply when a center becomes inactive:

- Any periodic fee linked to the center record is not stopped.

- Transactions can still be made.

- A miscellaneous penalty or any amount that is due remains due.

- The system will not allow users to apply any periodic fee type to the account except for an upfront fee and any miscellaneous penalty fees.

Follow these instructions:

- Click Clients & Accounts.

- In the Search box, type the name of the center and click Search.

- In the results box, click the name of the center you want.

The details page (dashboard) for that center appears. - Click Edit Center Status.

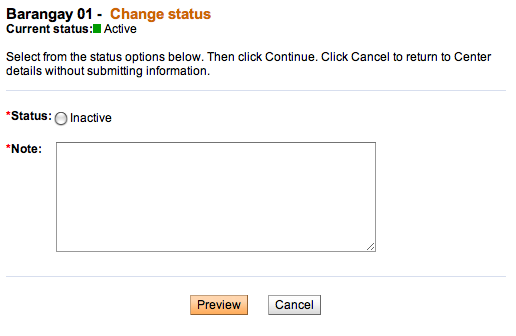

The Change status box appears. It might look like the following screen:

- Click the button for the new status.

- In the Note box, type a note explaining why this status is changing.

- Click Preview to review your change.

- If you want to make further changes, click Edit Status, make any changes, and click Preview again.

How to change the status of groups and/or clients

The following table shows the various states that a client can be in:

| State | Description |

| Partial application |

Assigned to the client if the record has been created, but data is incomplete or the user does not want the status to be as “Pending Approval”, status can be marked as “Partial Application”. |

| Pending approval |

This is an optional state and can be omitted during the initial system setup by the MFI. Record contains all necessary data and is waiting for approval. Before and after this point, there could be some offline processes, which might govern the approval process. These processes can be specific to each MFI and will not impact Mifos functionality. A record can be saved in this state after the mandatory fields (according to the attributes table) have been filled. |

| Active | Client has been Approved and is eligible to open a savings account or apply for a loan, or is eligible for other products offered by the MFI. Every client has to have a loan officer to be active. |

| Cancel | A client application can be cancelled due to various reasons: • Client can withdraw the application • The application was rejected by an Officer of the MFI • The client is not eligible, as the client has been Blacklisted • A duplicate client record already exists, and thus one record is being cancelled. |

| On hold |

This status means: • No new accounts can be opened for the client. • Interest in the client’s savings account will keep on accumulating, but no withdrawals will be allowed. Deposits will be allowed. • No new loans will be disbursed to the client, but repayments for current loans will be as scheduled. On Hold status of a client should be indicated on all the client’s accounts to ensure that the client is unable to operate the accounts. On Hold status can either be changed to Closed or Approved. The rules of the respective status will then be applicable on the record. |

| Close | A client record can be closed to indicate that the client is not banking with the branch anymore or a duplicate record for the client exists in the system. The flags associated with this state are: Transferred, Duplicate Account, Blacklisted, Left Program, and Other. Once closed, client can reapply again but the client record has to follow the complete application procedure. |

The following table shows the various states that a group can be in:

| State | Description |

| Partial application |

If the record has been created, but data is incomplete or the user does not want the status to be “pending approval”, the status can be marked as “Partial Application”. Group creation status defaults to this status if configured by the MFI. |

| Pending approval |

This is an optional state and can be hidden by the MFI.during the initial system setup and configuration. The status means that the record contains all necessary data, and is waiting for approval pending any MFI manual process. When a group is created, this is the default status if the user does not have access to 'approve' status. |

| Active/Approved | Group has been approved and is eligible to open a savings account or apply for a loan, or for other products offered by the MFI. To be Active, every Group must have a loan officer assigned. |

| Cancel | A group application can be canceled due to various reasons, which include withdrawal of the application; the application was rejected by an officer of the MFI; the group is not eligible as it has been Blacklisted; or a duplicate group record already exists and thus one record is being canceled. |

| On hold |

If the group status is marked On hold, it will have the following implications:

|

| Close |

|

Follow these instructions to change the status:

- Click Clients & Accounts.

- In the Search box, type the name of the group or client and click Search.

- In the results box, click the name of the group or client you want.

The details page (dashboard) for that group or client appears. - Click Edit Group Status or Edit Client Status.

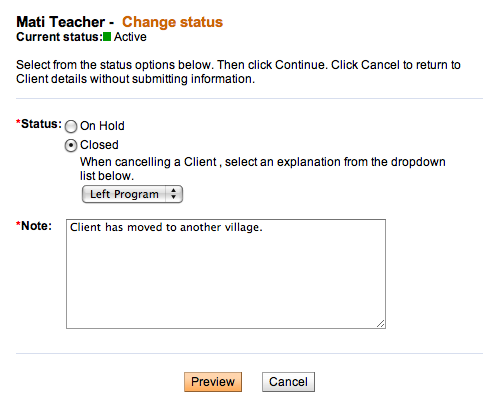

The Change status box appears. It might look like the following screen:

- Click the button for the new status.

For a group, if you click Closed, click a reason from the list immediately below. - In the Note box, type a note explaining why this status is changing.

- Click Preview to review your change.

- If you want to make further changes, click Edit Status, make any changes, and click Preview again.