Introduction to loan accounts

- What is a loan account?

- Group loans versus client loans

- The loan account "dashboard"

- Loan account summary

- Group loans individual monitoring (GLIM)

What is a loan account?

A single MFI typically has several loan products, for example, a 4-year housing loan, and a 2-year educational loan. The product provides the terms and definitions of these different programs to the Mifos system. Loan products are available to the whole MFI.

If a customer wants to have a 2-year educational loan, the MFI uses the 2-year educational loan to create an account for the customer. The loan account is used to track transactions related to the loan, which include interest, repayment, and any applicable charges. The loan account is a specific instance of a loan product, with a specified interest rate and an account number, and it is owned by a specified MFI customer.

Group loans versus client loans

If your MFI is structured to have groups as well as clients, you have a choice of issuing group loans or individual loans. With group loans, the group as a whole is responsible for repayment and fees, and each individual in the group has a designated responsibility to pay their part of the debt.

The benefits of the group include the following:

- By vouching for other members of the group, the group does the work of checking the creditworthiness of each individual in the group.

- By co-signing the loan, the group provides insurance of payment by individuals.

- The group provides reinforcement, esprit de corps, and encouragement to individuals to bear their part of the debt responsibility.

The loan account "dashboard"

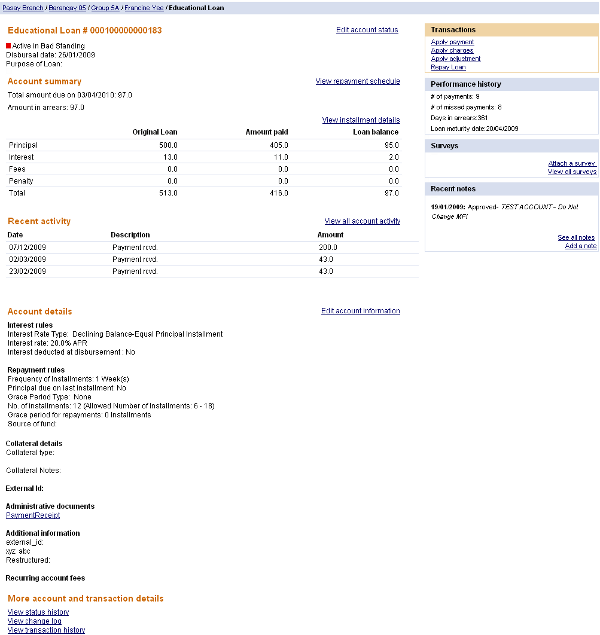

At any point, you can look at the details of a loan to find out its terms and its current status. Such a dashboard might look like this:

The following table summarizes the sections of the dashboard:

|

Category |

Description |

|

Loan account header |

Loan account number, current status, disbursal date, and purpose of the loan |

|

Account summary |

Shows the loan amount, amount paid, and the loan balance broken down by the principal, interest, fees, and penalty. It includes a link to the repayment schedule. |

|

Recent activity |

A list of transactions that have taken place with regard to the loan. |

|

Account details |

Shows the loan account details, which include interest and repayment rules and collateral details. It includes a link to a section where you can create a receipt for payment. |

|

More account and transaction details |

Shows the status history, change log, and change history for the loan account. |

|

Transactions |

Provides the links to applying a payment, an adjustment, or a charge to the loan account. |

|

Performance history |

Show various loan account performance indicators. |

|

Recent notes |

Shows the three most recent notes appended to the loan account, with additional links to add a new note or view all the notes. |

Loan account summary

The section displays the original loan, the amount paid and the balance for the principal, the loan interest, and the total fees and penalties on the loan account. These amounts are further subdivided by the balances for the loan account, the amount paid, and the loan balance. Totals for the original loan related amount, the amount paid, and the total loan balance appear as well.

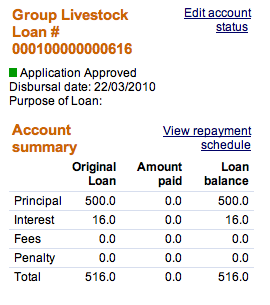

The summary might look like this:

The following table explains the entries shown on this page.

|

Original loan |

Amount paid |

Loan balance |

|

|

Principal |

The original loan amount. This cannot be updated once the account has been approved. |

The amount paid against the principal up to the present date. |

Original loan minus the amount paid. |

|

Interest |

A computed value showing the interest due from the loan account based on the original loan amount. |

The total interest paid up to the present date. The amount paid can be greater than the amount calculated in the original loan if interest can be recalculated. |

The amount of interest remaining on the loan. |

|

Fees |

The amount expected from this account according to the fee types attached to the account. |

The amount paid against fees and miscellaneous fees up to the present date. |

The unpaid fee amount expected from this account. |

|

Penalty |

Zero at the start of the loan. |

The total penalty amount paid up to the present date. |

Penalties charged but not yet paid up to the present date. |

|

Total |

The total of the amounts listed above. |

||

Repayment schedule

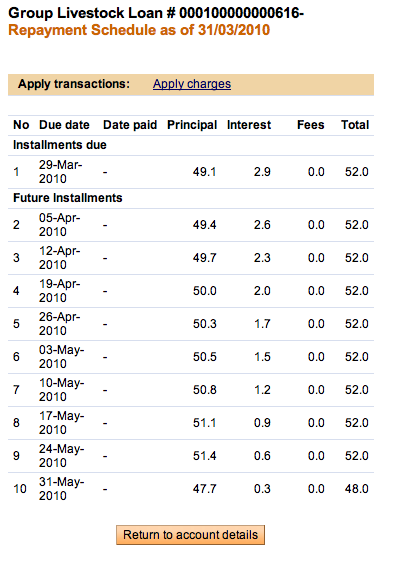

At any time, you can look at the repayment schedule (including all repayments to date, the number of repayments, due dates, and so forth) for a group or an individual loan. While you are looking at this page, you can use the links there to apply payment adjustments and charges.

The page might look like this:

The following table explains the entries on this page:

|

Column name |

Description |

|

Installment No. |

Sequence number of the installment. |

|

Due Date |

The first due date is the first repayment start date. If the loan is disbursed during a meeting, the repayment Start Date is the disbursal date + frequency of loan repayment + grace period duration (considering holidays and nonworking days). If the meeting day falls on a holiday, the new repayment date will be the next working day or the next repayment day, depending on how Mifos has been configured. No penalty is calculated for the period between the actual repayment date and the new repayment date. In case the loan duration extends beyond the current year, the system will create the repayment schedule for all years. However, the system assumes that the subsequent years have NO holidays. When the holidays next year are defined in the system, the repayment schedule for that year will be regenerated, taking into account the Holidays specified. If payment is not received, the penalty will be calculated from the new rescheduled date. Succeeding Installment Due Dates are calculated based on Previous Installment Due Date, holidays, and nonworking days as defined by the MFI. In case of holidays, if the head office configures it to be Next Repayment Day, no penalty will be calculated for that period. Penalty calculation will start if the client does not pay on the next repayment day. |

|

Date Paid |

The date when payment for the installment was received. |

|

Principal |

Principal paid or due, in the next payment or in the future. |

|

Interest |

Interest paid or due, in the next payment or in the future. |

|

Fees |

Fees paid or due, in the next payment or in the future. |

|

Total |

Total of the Interest + Principal + Fees. |

Missed Installments

If a client or group misses payment for an installment, the same amount is included in the next installment due. For example, if the client has to repay 0 (principal = and interest = ) every month, and he or she defaults for the month of August, then for the month of September, the installment due (including penalty) is 2. The following computation shows how the 2 is arrived at:

Principal due

Interest due

Penalty due (for the missed/defaulted installment)

Principal overdue (for the missed/defaulted installment)

Interest overdue (for the missed/defaulted installment)

Total amount due 2

Partial payments are accepted.

Group loans individual monitoring (GLIM)

Mifos currently offers two major types of loans, individual and group. In an individual loan, the individual is totally responsible for repayment of the loan and for payment of any associated fees. In a group loan, the group has a single loan account, and the group is the primary unit that the MFI interacts with; a single repayment schedule is maintained for the entire group. The group provides credit worthiness to all its members; if one member is delinquent in the group, then all the contracting group members are also considered delinquent.

If your MFI wants to do things differently-that is, if it wants to keep the credit worthiness of each individual in a group loan separate-it can use GLIM (group loans individual monitoring), which calculates performance history separately for each individual participating in a group loan.

With a GLIM loan, the group is still the primary unit that participates in transactions, but the performance history of each contracting member is calculated in a slightly different way when compared to how it is calculated for a regular group loan.

In a GLIM loan, all transactions (disbursals, payments, adjustments, bulk entry, and so forth) take place at the group level. The only major difference between GLIM and the usual group loans is that the initial loan account creation specifies the amounts given to each individual, the purposes for these amounts, and the way these loans affect the calculation of individual performance metrics.

Note: At the time of configuration, you must decide whether your group loans will be standard or will use GLIM. Once set, this option cannot be changed after deploying Mifos.